Northwest Bio (NWBO): They just don’t like having to turn over the cards

An $890m market cap company consistently on the brink of bankruptcy?

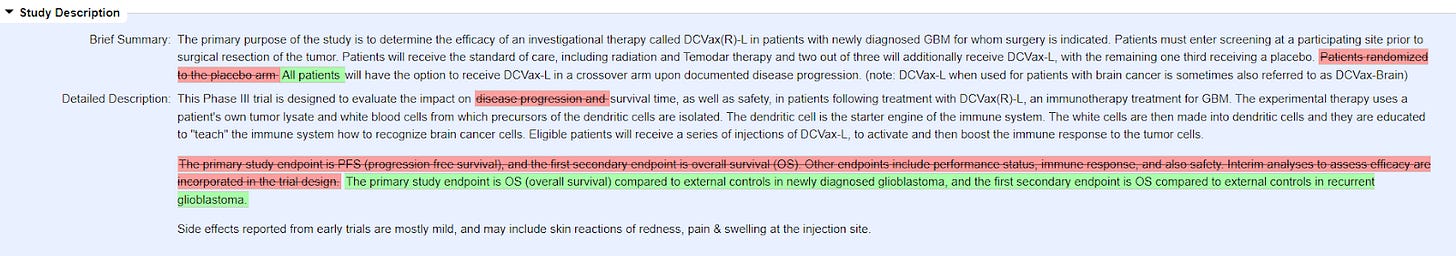

I’ve been doing this for a long time and I don’t think I know of a more ludicrous story than Northwest Bio. This company avoided disclosing the data from their Phase 3 trial of DCVax-L in patients with glioblastoma for YEARS. And they really had no good excuse for it, they hadn’t enrolled an additional patient after 2015 and yet only disclosed the data in 2022. Think I’m exaggerating? Here is what they said in their paper that was published in 2018:

We conducted this study at over 80 sites in 4 countries: the US, Canada, Germany, and the UK. Patient recruitment was initiated in 2007, and was paused from 2009 to 2011 for economic reasons. The midpoint of enrollment was reached in May of 2014, and the final patient was enrolled in November of 2015.

And it’s not like this gap was planned, the company kept claiming data was just around the corner. Here is what CEO Linda Powers had said at an Oppenheimer conference in 2014:

I’m just going to spend one minute or two going through DCVax-L. I really pretty much covered it. And this is the Phase III trial. It’s blinded. Looking towards 2015, we expect to finish enrollment… We expect to finish enrollment in the Phase III trial, hopefully in around September time frame, it depends a little bit on how fast, how many more of the European sites come on. But, we expect to finish about then. And we expect topline results to be about 3 to 5 months after full enrollment. So around the end of next year or slightly after, we expect to be reaching the finish line on that Phase III trial.

And just so we are clear on the timing, she was asked for some clarification.:

Conference attendee #5: And another question that I had, is that given the timeframe that you sketched for the DCVax-L, it looks like you probably will have data in, let's say in mid-2016? What are you thinking the...

Linda Powers interrupts: No, no, no, no. No, well, if you know if the patients, umm, depending on the patients, of course. No, we think it is more like close to the turn of the year. Like the beginning of 2016, not the middle.

And then here is the CEO saying she expects data at the beginning of 2016 sometime. Fast forward to February 2017 and they announce that there haven’t been enough events for the overall survival endpoint:

The PFS events have surpassed the 248-event threshold, but the OS events have not yet reached the 233-event threshold. Based upon the pace of OS events during the last six to eight months, the Company's current anticipation is that it will be several months until the Trial reaches 233 OS events.

Several months went by and nothing. You actually have to fast forward an additional 3.5 years to get to the actual data lock! By then, almost everyone in the trial was already dead for quite some time. But the delays don’t even end there, it took them an additional 2 years to actually announce the data in November 2022 (note that this was a non-exhaustive list of all of their promises, evasions and misdirections).

And in the end, the data was garbage. Because of a crossover design, they couldn’t really use the original placebo arm so they had to use “external controls”, which basically means they could make up whatever they wanted. Their entire conduct of the study and release of the data was eviscerated in an epic takedown in an article in Neuro-Oncology, the publication of the Society of NeuroOncology (emphasis added):

An initial report on the trial in 2018 reported only on the combined overall survival (OS) data of both study arms and failed to report on PFS, the primary study endpoint. The argument for not publishing the primary endpoint was an ambiguous statement about an expert panel being required because of the complex determination of progression.

…

Now, more than four years later, a second report is available, which is surprisingly named “A Phase 3 Prospective Externally Controlled Cohort Trial”. This is a remarkable title, as the investigators have re-analyzed the OS data of the study against published external controls and present this as a prospective trial. It is obvious, however, that this is not a prospective analysis but a post hoc retrospective analysis: the investigators had seen the data, both of their own study and of the cohorts taken for comparison and then decided to go ahead with cross-trial comparisons. The authors state that the PFS endpoint became infeasible because of pseudo-progression issues, however, to the best of our knowledge in no other study that issue has resulted in abandoning the primary endpoint. Fortunately, the numerical PFS data are now presented: the median PFS was 6.2 (95% confidence interval CI 5.7–7.4) months for patients receiving DCVax-L and 7.6 (95% CI 5.6–10.9) months for the placebo group and not statistically significantly different (P = .47). Thus, the clinical trial did not reach its prospectively defined primary endpoint and with that, the investigators de facto declare the randomized trial in its original and prospective design to be negative.

Note that the placebo arm did better than the treatment arm in PFS. And just to put a finer point on this, as of the October 14, 2016 clinicaltrials.gov update (almost a year after full enrollment), PFS was the primary endpoint of the trial (doing the math on the PFS, that means that the last patient in probably progressed by the middle of 2016, yet the company didn’t announce the data). Only in the May 18, 2022 update (which was AFTER they reported that the placebo arm actually did better in the primary endpoint) did they update it to overall survival!

But the articles of that article in Neuro-Oncology weren’t finished with the evisceration of the data, this time on the external control population (emphasis added):

So yes, all these trials were on glioblastoma and all randomized patients after radiotherapy but major differences in trial design and enrolled patients exist which correlate to well-established prognostic factors. Although the authors state that patient demographic characteristics and prognostic factors of the DCVax-L cohorts were well matched with the ECPs for both the primary and secondary end points based on the criteria pre-specified in the statistical analysis plan of this retrospective study, major prognostic patient and tumor related factors such as age, steroid use, performance status, and extent of resection were not used for matching.

They conclude with this paragraph:

In summary, despite this report on a research program spanning 15 years, clear conclusions on the activity of DCVax-L in glioblastoma cannot be drawn—the major methodological limitations of the recent publication with clear confounding factors simply do not allow that. Moreover, while the investigators describe their approach as innovative with wider general applicability, the mutation of a negative randomized clinical trial with replacement of primary and secondary endpoints as well post hoc introduction of “control patients” by pooled and inferred external control data requires validation by prospective studies before it is considered for implementation as high-level evidence.

The company isn’t done with drawing things out though either. First, instead of deciding to file with the FDA or even EMA for approval they have decided, for some reason, to file with the UK Medicines and Healthcare Products Regulatory Agency (MHRA). Why that is, I couldn’t say, maybe because the FDA might just send them a refusal-to-file letter right out of the gate? Also, I’m guessing it will be extremely hard to get reimbursement in the UK, which is a notoriously difficult jurisdiction for any premium priced product. Anyway, here is what the company said at the end of August of this year:

The Company anticipates submitting the MAA in approximately the next 30-45 days. The Company plans to request that the MHRA review the MAA under the 150-business day process that the MHRA has established to accelerate the availability of new medicines for patients in the U.K.

So that means they would have filed by the end of September or mid-October? Nope.

On October 13th they pushed the timeline mid-to-late November with what I would call a convoluted press release:

The Company reported that the majority of the MAA has been completed, and all but one of the key sections of the MAA have been delivered to the publisher. The publisher is an independent party who does the final step of the preparation for the submission: formatting, checking references and the like.

The Company and its consultants are working intensively to finalize this last key section of the MAA, after overcoming an unexpected delay in that regard. The Company strongly believes that after so many years of work on the DCVax-L program, taking some additional time to help ensure that the full MAA package is as strong as it can be is especially important since the Company plans to submit applications to multiple regulators.

This is a company that took two years after data lock to actually release full results so I’m guessing they will continue to find excuses to delay getting any actual answer from the MHRA. Have to keep the music playing! I remember a while back my colleagues and I would joke about starting a biotech company called Ponzi Pharma, with a lead drug Placebex. We would run a survival trial in diabetes and then wait for everyone to die before releasing data. We were joking but Northwest Bio seems to have gone through with it!

Now I know there are members of the retail cult saying that all this is normal and excusing the company’s behavior for this or that reason. It really isn’t normal. Celldex was able to enroll a 745-patient Phase 3 trial in glioblastoma patients in 5 years and published the data less than a year after completion, and they had an overall survival endpoint. Compare that to the 16-year saga of the Northwest Bio Phase 3 trial, a trial that started in 2006 and only read out in 2022.

This brings me to another point. What the heck are they spending money on exactly? Look at their 10-K, they spent $89.5 million the last three years on R&D. This for a company that wasn’t enrolling their Phase 3 trial for several years and doesn’t seem to have any other trials going on. Just to give you a sense, if you assume $100,000 per patient for a clinical trial, this spend is equivalent to a 900-patient trial. Where are those 900 patients? I understand there are other fees of course but how can they justify that level of spend? And who is getting that money? Their G&A spend is another issue, as they have spent $121 million over the same period. This is a company with 22 full time employees.

Which brings me to another point, this company is effectively insolvent. As of June 30, 2023, they had a total of $1.4 million in cash and that’s it. Then they had $12.1 million in accounts payable, another $6.6 million in accounts payable to related parties, $1.9 million in convertible notes due in the near term and an additional $8.4 million in notes payable due in the near term. Then another $15.7 million due past one year. In total their total stockholders’ deficit (negative stockholder’s equity) is $61 million! They also burned about $22.8 million in the first 6 months of this year.

Now I am not saying that they are going bankrupt immediately, they have been on the verge for years but somehow Linda Powers has kept the shell game going. See this list of Subsequent Events in their 10-Q:

Between July 1, 2023 and August 9, 2023, the Company received $2.1 million in funding from the sale of preferred shares and proceeds of debt arrangements and proceeds related to a gain contingency.

Between July 1, 2023 and August 9, 2023, the Company issued approximately 84,000 shares of Series C preferred stock for proceeds of $1.1 million.

In July 2023, approximately 24,000 Series C Shares with a book value of $0.4 million were converted into 0.6 million common shares in accordance with their terms at a ratio of 1:25.

Between July and August 2, 2023, the Company issued approximately 4.9 million shares of common stock to a lender in lieu of cash payments on $2.5 million of outstanding debt, including $0.1 million interest. The Company also issued 0.3 million shares of common stock to that lender to extinguish $0.2 million Share liability.

On July 11, 2023, the Company entered into a one-year convertible note (the “July Convertible Note”) with an individual investor (the “Holder”) with an aggregate principal amount of $0.5 million. The Company received $0.5 million cash from the July Convertible Note. The July Convertible Note bears interest at 10% per annum, and is convertible into Series C preferred shares at $12.50 per share at the Holder’s sole option. The Series C preferred shares are convertible into common stock 30 days after the debt conversion date. Each Series C preferred share is convertible into 25 shares of common stock.

Between July 1, 2023 and August 9, 2023, the Company received $0.5 million in additional non-dilutive funding related to a gain contingency.

The company is basically being held together by snot and baling wire. Of course, all these maneuvers have a cost in the form of dilution. Between April 1, 2023, and June 30, 2023, a whopping 32 million shares were issued. And over the prior year almost 81 million shares were issued. This is why the company has over 1.1 BILLION shares outstanding. This is one reason why the long-term chart looks like this:

Another thing is that given this is an $890 million company, you would think there would be institutional holders in there, you would be wrong. Institutional ownership is 0.27% of the total! Besides no institutional ownership, there doesn’t appear to be any sell-side coverage either. This for an $890 million company in constant need of cash? I know a lot of investment bankers and they will fund almost everyone (and use equity research as a carrot to get the banking business). They don’t really care about the story. The only thing that would stop them would be compliance, which has to be the case here. The biggest whores on Wall Street think this company is too dirty to do business with. Think about that.

The SEC isn’t that thrilled with them either. Here is what they said in 2019 when the settlement with Northwest Bio was announced (emphasis added):

According to the SEC's order, NWBO publicly disclosed material weaknesses in each of its Forms 10-K over a period of twelve years, from 2007 through 2018. NWBO's material weaknesses often repeated year after year, relating to numerous areas of importance, including the review, supervision and monitoring of accounting operations throughout the organization. NWBO disclosed in nine of the last twelve fiscal years that it lacked controls in place, including those surrounding related party transactions, to ensure that all material transactions and developments impacting its financial statements were reflected and properly recorded. In its most recent Form 10-K filed for FY2018, NWBO continued to disclose material weaknesses, including two newly-identified weaknesses, one of which is the lack of formalized and implemented policy and procedure documentation to evidence a system of ICFR. In addition, NWBO has failed to file timely its annual report on Form 10-K for sixteen consecutive years.

Those “related party transactions” were about Cognate, a contract manufacturer that is effectively owned by CEO Linda Powers (emphasis added).:

Cognate, a cell-based specialist manufacturer, is the CMO for NW Bio’s lead cancer vaccine DCVax but is also a part of (and created by) the venture group Toucan Capital Fund III--an entity controlled by NW Bio’s CEO and president Linda Powers (she serves on the CMO’s board and is MD of Fund III) and her husband.

According to a report published last October by analysts at Phase Five Research (a company that held a short position on NW Bio), since 2004 around $310 million in cash, shares, warrants, options and other benefits had been transferred from Northwest to the Toucan Group.

Of course, I’m sure it isn’t helping that they are suing Wall Street for “stock manipulation”. Here is how Citadel responded:

“This frivolous lawsuit appears to be nothing more than an attempt by Northwest Biotherapeutics to divert attention away from its long history of governance and management failures, SEC charges for financial reporting lapses, and lawsuits from its own shareholders,” a Citadel Securities spokesman said. “We intend to pursue any and all legal action against Northwest Biotherapeutics for making these false and baseless allegations, which only undermine the integrity of our capital markets.”

You can see this company is a complete basket case on numerous levels and really always has been. I’ll finish off with this gem from 2007 (h/t Jacob Plieth). Here is where they announce that they have received authorization to make their product commercially available in Switzerland:

And then here is where they contradict that statement one week later, noting “certain reports have also erroneously indicated that the Company has received a Marketing Authorization from the Swiss authorities. Such reports are incorrect.” Hmm, I wonder where they got that idea from???:

I hope you found this as entertaining as it was for me to write!

Please like, share and subscribe!

Stocks mentioned:

$NWBO

Amazing - this is worth a show. Had a good giggle thanks for that.

Nice hit piece Adam. Does a Wells Notice prevent you from writing using your own name or on StatNews?