It probably isn’t fair for me to pick on a company developing a drug for Alzheimer’s as almost nothing works and that part of the biotech sector is full of charlatans, but really I couldn’t resist with this one (and honestly probably won’t be able to resist others in the future). The company just seems to be in a perpetual fever dream.

Annovis is developing buntanetap (formerly known as posiphen and ANVS401) for the treatment of Alzheimer’s and Parkinson’s. It is currently enrolling a 320-patient phase 2/3 study for Alzheimer’s and completed enrollment of its 523-patient phase 3 Parkinson’s study in June, which is expected to readout by the end of the year. So far so good right? An advanced pipeline in some huge indications. Not if you know the history or the prior clinical data or had any dealings with the management, especially CEO Maria Maccecchini, who runs the show. This is a promotional company that has PR headlines such as “ANNOVIS BIO ANNOUNCES THE FILING OF A GROUNDBREAKING PATENT”.

Annovis acquired buntanetap from TorreyPines Therapeutics in 2008, when Annovis was known as QR Pharma. TorreyPines had acquired it from Axonyx, after Axonyx completely blew up in a phase 3 trial in 2005 with a related molecule phenserine. How related? Related enough for the company to have to put this paragraph in a press release last year making the case that they are different:

Buntanetap, previously known as ANVS401 or Posiphen, is sometimes mistaken for phenserine. However, Buntanetap is the pure (+) enantiomer, i.e., mirror image, of (-) phenserine. The two compounds are totally different drugs as they have different efficacy, mechanisms of action, and there is no chiral switching between them or their metabolites. Phenserine is an acetylcholinesterase inhibitor, similar to Aricept or Exelon, while Buntanetap inhibits the translation of neurotoxic aggregating proteins. Both compounds derive from the intramural research program at National Institute of Aging, a division of the U.S. National Institutes of Health. Phenserine was invented in 1995, while Buntanetap in 2002. Both enantiomers were licensed to Axonyx, Inc., which developed phenserine into phase 3 clinical studies. Axonyx merged with Torrey Pines Therapeutics, which licensed Buntanetap to QR Pharma in 2008 that became Annovis Bio in 2019.

Now let’s move to the data and there honestly isn’t much to point to in order to make you confident. In July of 2021 the company released data on 14 Alzheimer’s patients and 54 Parkinson’s patients. To call it confusing would be an understatement. Check out this slide and try to understand what they were thinking when presenting data this way:

And then for some reason the data they presented was efficacy at 25 days which is not an approvable timepoint for diseases like Alzheimer’s and Parkinson’s. But that’s what we have, so let’s take a look shall we? Here is the data from the Mini-Mental State Examination (MMSE) endpoint. A higher MMSE score is viewed as better, so it looks like placebo actually did better than treatment on this measure in both sets of patients.:

Now let’s look at the data from the Clinical Dementia Rating Scale-Sum of Boxes (CDR-SB), which was a primary endpoint for the pivotal trials of both Aduhelm and Leqembi from Biogen. In this case a lower score is better and once again, the placebo arm outperformed the treatment arm.

Buntanetap did show trends in their favor in the four in the four ADAS-Cog tests compared to placebo but none of those were significant and in ADAS-COG14 placebo and buntanetap are practically indistinguishable:

So really not much to go on. Yet somehow they decided to invest the time and effort into a 320-patient trial which for some reason doesn’t even feature the dose (80mg) that was used in the original trial at all. They are testing 7.5mg, 15mg and 30mg for up to 12 weeks. Another item to note is that they are using a 12-week endpoint, which even Leqembi would have had a hard time hitting, despite the drug eventually working. See the below from the Leqembi label. Even in the very off chance that buntanetap has efficacy, they probably wouldn’t be able to show it due to how the trial is designed.

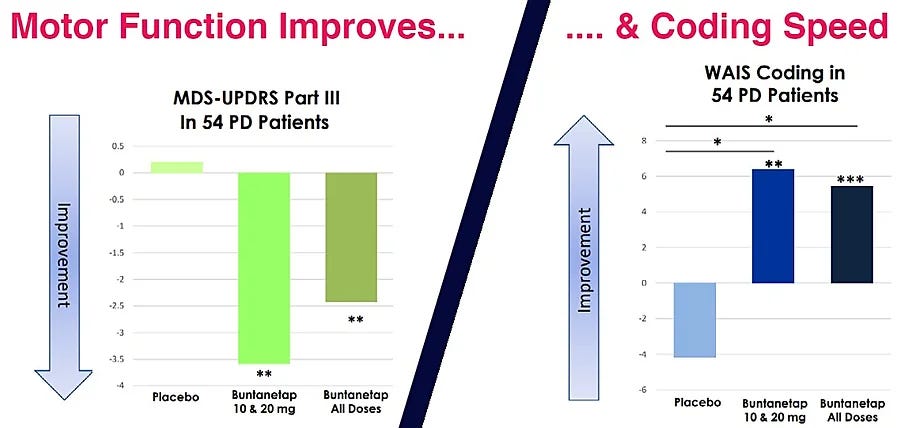

Now let’s move on to Parkinson’s. That data is a bit confusing as you can see here. They tried a wide range of doses and for some reason the higher doses of 40mg and 80mg did worse than 10mg and 20mg on the Movement Disorder Society-Sponsored Revision of the Unified Parkinson's Disease Rating Scale (MDS-UPDRS) test. And then 5mg did worse than placebo.

But then things look completely different on the Wechsler Adult Intelligence Scale (WAIS) Coding endpoint where 5mg, 20mg and 80mg were statistically better than placebo but then 10mg and 40mg weren’t. Not sure I’ve ever seen such random data before. It’s like it was created by a random clinical trial result generator.

Of course the company doesn’t like it presented this way so they have condensed things quite a bit in their investor deck so that investors never have to wonder why higher doses did worse or why 10mg worked in one endpoint but not the other:

It’s on this basis that they started their 523-patient phase 3 study in which they study buntanetap at 10mg, 20mg as well as placebo. This trial enrolled extremely well as they started it in August 2022 and then completed enrollment in June 2023. Not bad. Though some of that might be because they had 67 sites so each site was only required to provide them with around one patient per month.

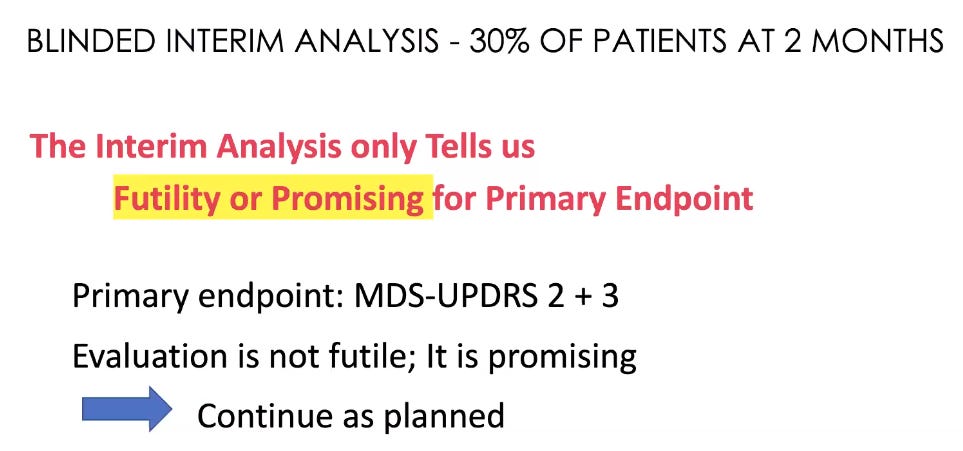

Of course, like everything else that the company does, this trial has some weirdness associated with it. Here is what the company disclosed on March 31st in an SEC filing on their interim analysis:

The Company has received the results of the pre-planned interim analysis conducted by a data analytics provider based on 132 patients from all cohorts collectively for which baseline and two-month data was available. As the interim analysis was conducted at two months of the six-month endpoint and only on 132 patients, it may not be indicative of the results at six months for the full patient population because as the trial progresses, clinical outcomes may materially change as patient enrollment continues and more patient data become available, or different conclusions or considerations may qualify such results once additional data have been received and fully evaluated. Based on the results of the interim analysis, the Company intends to proceed with the trial as planned in accordance with the previously established protocol. The Company remains blinded to the Phase 3 trial and does not have safety or efficacy data from the trial. A separate safety interim analysis is in process and the Company expects that interim analysis to be released in the second quarter of 2023.

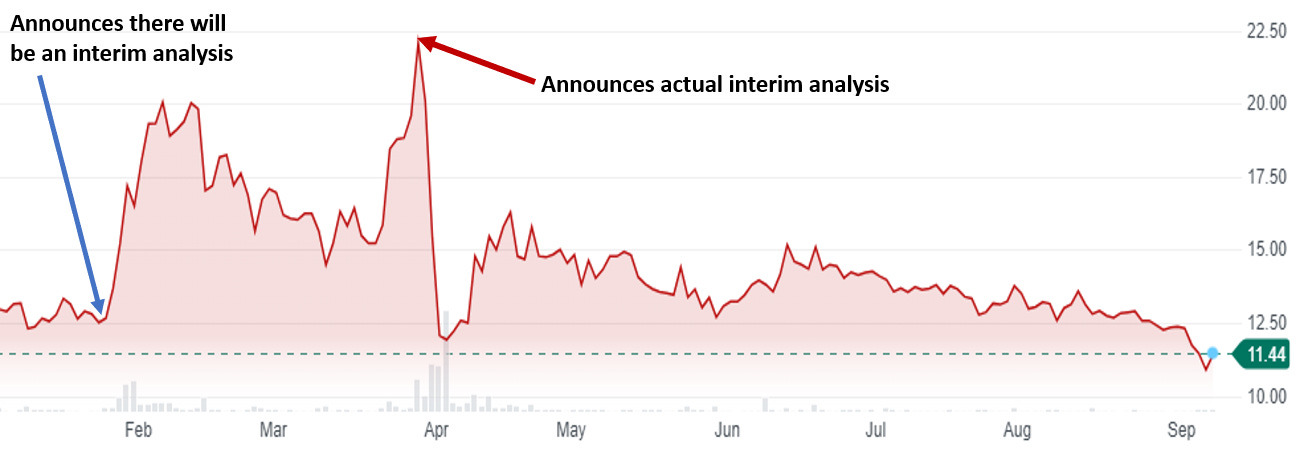

Doesn’t that sound rather defensive to you and that the interim might have been negative? They tell you no data but then say you can’t necessarily trust the data. I’ll grant you it could also be legalese. Regardless, thanks to this announcement the stock fell 45% in two days and really hasn’t recovered at all. Essentially the company erased whatever gains they got from the initial interim analysis “pump”.

And then I’m not sure the company did themselves any favors with their hastily put together “R&D Day” (which was not even an hour long as it included 20 minutes of management comments and then 30 minutes of questions). On that call, analysts had to ask about that interim several times as the comments from management didn’t quite make sense:

So as Michael already said, the interim analysis was misunderstood. And I take the blame for that because I talked about data. The interim analysis gives probabilities, not data. And data sounds like something very, very clear. Unfortunately or fortunately, it was blinded. We did not want to ruin the study. And really, all it shows us is go, no go. Is – are the two doses different from baseline and placebo? If yes, it's a go. If no, it's futile and we do not keep going.

Here is what the company said in the initial press release on the interim that got the stock moving. Almost like they are describing two different interim analyses:

Based on the current enrollment, the Company anticipates having a sufficient number of patients who have received two months of therapy to conduct an interim analysis in the second quarter of 2023. The purpose of the interim analysis is to determine if the Company's original estimates for patient enrollment in the Phase 3 trial (150 patients per arm) will be sufficient to observe a statistically significant treatment effect in both scales between the active arms and the control arm of the study after six months of treatment.

More specifically, the interim analysis could confirm that 150 patients is the optimal number, or it could inform that less patients are needed (the efficacy is better than expected) or that more patients are needed (the efficacy is less than expected). The boundaries of the extent to which we will decrease or increase the number of patients is +/- 25% or between 112 and 200 patients per arm.

And according to this slide, the two choices were actually futile/promising (not sure the Annovis lawyers actually ever looked at this deck or maybe their law firm is based in a van down by the river)?:

Then there were these comments that weren’t helpful:

So the interim analysis we did is blinded but it looked at UPDRS II and III, the two primary endpoints. And in both cases, it looked that is it better than placebo, better than baseline for both UPDRS II and III, or is it the same? It's not the same. It's better. Both are better. Therefore, it's not futile. The study continues as planned, and we do hope that we're going to have positive data. Now, realistically, all we really know today is that our drug works at one month, that was the Phase 2; at two months, that is interim analysis; and now, we need to see whether it works after six months.

So if it was blinded, how did they look at UPDRS vs. placebo? Seriously, what am I missing here? It looks like other analysts were missing things too:

Question: Right. And so it seems from your comments today that there was – that the third party was looking at efficacy between the two or between the three treatment arms. And then what was conveyed to you? Just that there was above a certain threshold?

Answer: Nothing. That study was fine, that it was promising.

And then there is this exchange:

Question: Okay. And I guess I'll finish off with just one more. Is there – yeah, just back to the intern analysis real quick. Is there any, like potential bias maybe that the FDA could claim by the fact that we are kind of saying there is an efficacy effect that we're seeing from even though it's blinded from the efficacy data two months? Is there a way that a patient could hear that? And then it could potentially be construed as introducing more placebo effect?

Answer: That's a good question. But remember, we published our Phase 2 data. The patient can see that. The other thing, though, is the reason – I said, I should have never used the word data. It was also a little incorrect about what I saw. I personally, with an interim analysis, can say. It ended up saying a lot less than I hoped. And the reason for that is – at first, we were told yes, you can get whatever you want, and then we were told yes, but the FDA isn't going to like this, that and the other. And so we start cutting down on what we were asking. And so really, we don't know much.

Okay now one more exchange and I’ll stop beating the dead horse:

Question: Because the reason – I mean, it's coming from an investor standpoint. The reason I ask of, we hadn't seen the word blinded anywhere before that day. And so it – yeah, it was messed up and confusing. And so – and then the other question that kind of relates to that, today we see you got a no, a go or no go futility versus promising. Those words are also new versus what we saw before, which was sizing recommendations. Can you tell the difference?

Answer: Well, yes. So the size, we had the sizing recommendation that said keep going. Which means, we are not resizing. Okay. As I said, it came with less information than I hoped or expected because we are extrapolating from two months to six months. And see, at two months, all I can tell you, it's good. That's what we were told. But if you extrapolate from two months to six months, it could go up. It could be further. It could be the same. It could be worse. And that's why the recommendation we got was less clear than I hoped. So I got exactly what I should have gotten. But to be honest, it wasn't that clear to me either. So if you say whether I expected, I didn't expect anything better because go ahead as expected is the best we could have expected. But I did hope that we would get more than just promising.

Clearly talking to the CEO doesn’t clear things up here and you really just wonder if they are making it up as they go along. In their June 20th press release on the DSMB recommendation, the company really tried to spin things some more. They announced that the DSMB recommended that Annovis “continue the trial as originally designed”. But then uses language such as “the drug is proving to be safe and well-tolerated” and “the planned enrollment has been reached and based on this DSMB endorsement, Annovis is excited to announce that topline results are expected by the end of 2023” [all emphasis added by me]. And it is just unclear whether this was analysis that was done as part of the original one in April or was something different from that.

Regardless of the outcome of the trials, the future of buntanetap itself is rather cloudy. As mentioned above they recently announced a filing of a composition of matter patent for ANVS402, which is a “novel crystalline form of buntanetap”. And according to that press release “ANVS402 is expected to replace buntanetap in future PD and AD clinical trials after completion of a bridging study in early 2024.”, so they are just ditching buntanetap for a molecule which is novel enough to get composition of matter while not being so novel that they won’t require more than a bridging study? I’m guessing they are miscommunicating again and it’s more like a patent on a dosage form/formulation. Of course, I can’t really blame them for wanting to do a switcheroo. There are no composition of matter patents for buntanetap still around and even the use patents they have expire in 2031.

So where is the company financially? As of June 30th, they had $15.7 million in cash and cash equivalents and they burned $21.2 million over the first six months of the year, so looks like about a quarter and a half worth of cash, meaning they’ll run out around November/December, which coincidentally is when they should be coming out with Parkinson’s data. Running out of cash just short of a data readout is never good idea and is clearly because of some poor planning. But then again, planning is not something this company has ever been that good at.

Please like, share and subscribe!

Stock mentioned:

I haven’t deleted a single comment

Pretty much. They’ll try to pull an AVXL/SAVA thing by obfuscating. Wonder if they even will announce the full ITT dataset results