This is going to be an atypical post for me as I am a bit conflicted on this name. I am generally a value investor and so when I see a company with a $1 billion market cap, $350 million in cash, $410 million in annualized sales (based on Q323 results) and about $84 million in annualized income, I get interested. Seriously, how often do you see a biotech with a newly launched product with an EV/Sales of 1.5x and a P/E of 12.5x? Especially with orange book listed patents expiring between 2033 and 2040.

Of course, investors aren’t so stupid to completely miss such an opportunity and there is a reason for the super steep discount. Amylyx is a very controversial name with some key data coming out in the next few months, including Phase 3 data from the 600-patient Phoenix trial in ALS patients. While their lead product Relyvrio (AMX0035) was approved in September 2022, that approval was based on data from a 137-patient Phase 2 trial, so the Phoenix trial is viewed as the trial that will definitively answer the question on whether Relyvrio actually works or not.

If you are new to the story you might ask, if it’s approved and selling well, why are there still questions on efficacy? So let me give you some background. Relyvrio is a drug that combines Sodium phenylbutyrate, a pan-histone deacetylase inhibitor (HDAC) that is used to treat urea cycle disorders and taurursodiol (TUDCA), a Bcl-2 Associated X-protein (Bax) inhibitor, a naturally occurring bile acid used to help with liver support that is sold as a supplement in various places, including Amazon. If you think that is a weird mix, you wouldn’t be alone. Here is a bit of the origin story from STAT:

In 2013, Klee and Joshua Cohen, then undergraduates at Brown, were pondering why brain cells die in neurodegenerative diseases.

The two shared a passion for tunneling through dense academic literature at night. And so, after an exhaustive literature search, they came upon sodium phenylbutrate and taurursodiol, which they believed could help protect diseased neurons.

They had learned that neuronal health is regulated, in part, by two types of structures in the cell: the mitochondria, known as the “powerhouse” of cells, and the endoplasmic reticulum, which plays a major role in the creation, modification, and transport of proteins. So they theorized that the substances might help boost mitochondrial and ER function, and protect nerves from degenerating. Sodium phenylbutrate has been long used for other diseases, particularly those involving kidney dysfunction, and a form of taurursodiol is available for sale as a supplement — but they’ve never been used in combination to treat neurodegeneration.

Cohen and Klee’s thought, back then, was that the drug combination might ultimately help stave off the degeneration associated with Alzheimer’s disease. They contacted Rudy Tanzi, a prominent Alzheimer’s researcher at Mass. General — who took a liking to Cohen and Klee immediately, and decided to give them a hand with their hypothesis.

“When they first wrote to me in June 2013, they were just kids,” Tanzi recalled. “I thought it was a pretty naive idea, to be honest, but thought I’d go through this exercise with them — throw them some hard-to-do science. And now here we are, today, with a paper coming out.”

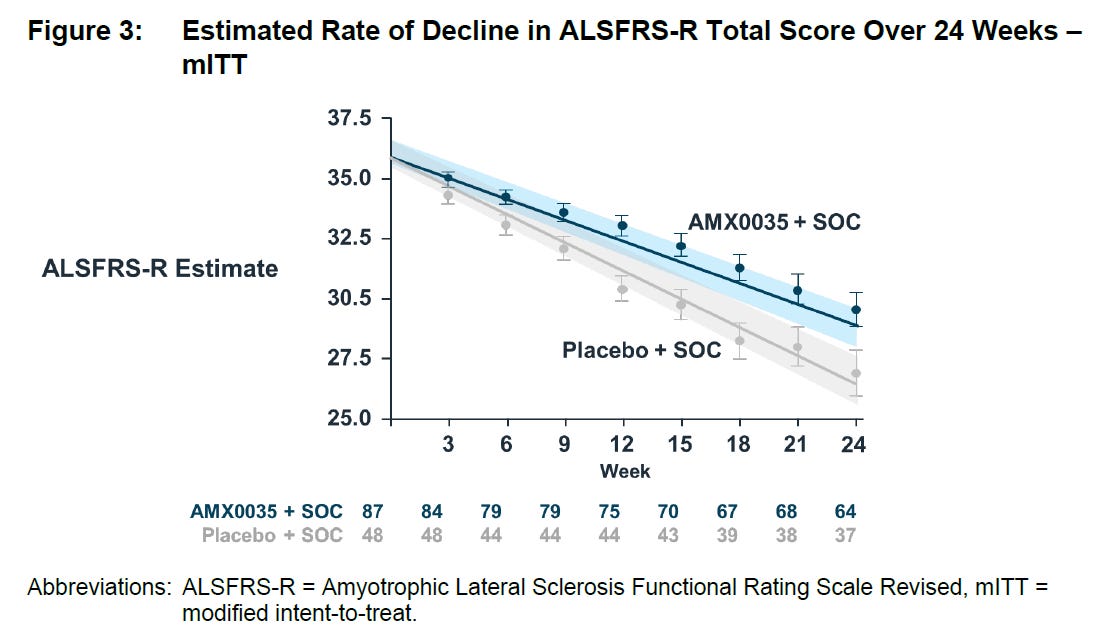

Fast forward to 2019 and they announced topline results from the Centaur study which showed a statistically significant improvement (p=0.034) in the decline of ALSFRS-R total score over 24 weeks:

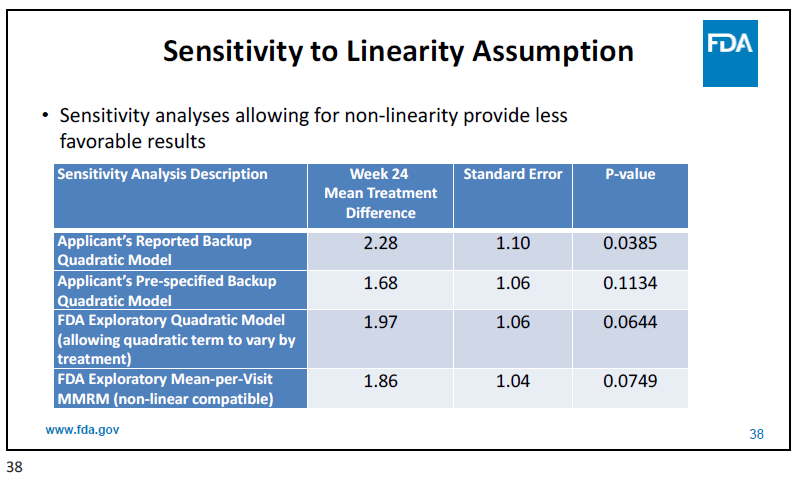

However, as the FDA mentioned in the briefing documents and at the advisory committee in March 2022, there is some hair on the data. For example, the statistics assumed a linearity in ALSFRS-R but the FDA believes it might be non-linear. Using those assumptions, the results lose significance:

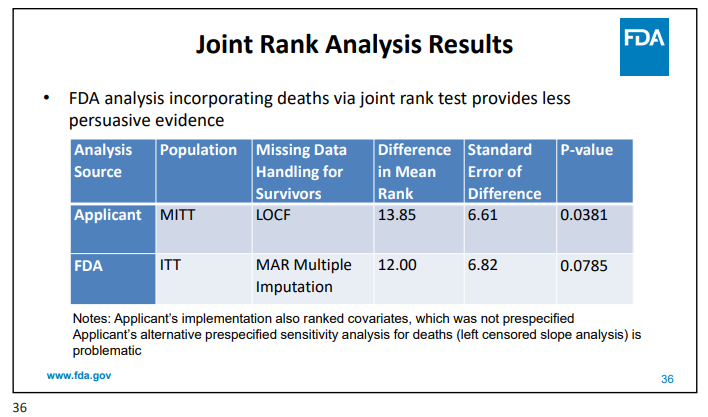

Additionally, deaths were not included in the primary analysis which the FDA believes might introduce bias. Once again, with some adjustments by FDA, the data loses significance.

There was also a higher proportion of patients starting edaravone or riluzole post-baseline in the drug arm (15.7%) compared to the placebo arm (4.2%), which obviously could have swayed the results, at least marginally.

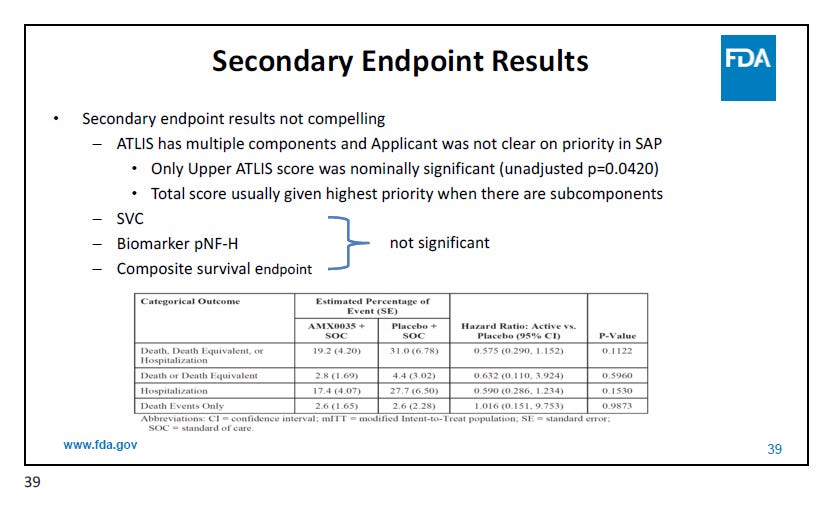

And then there is the fact that the secondary endpoints weren’t great:

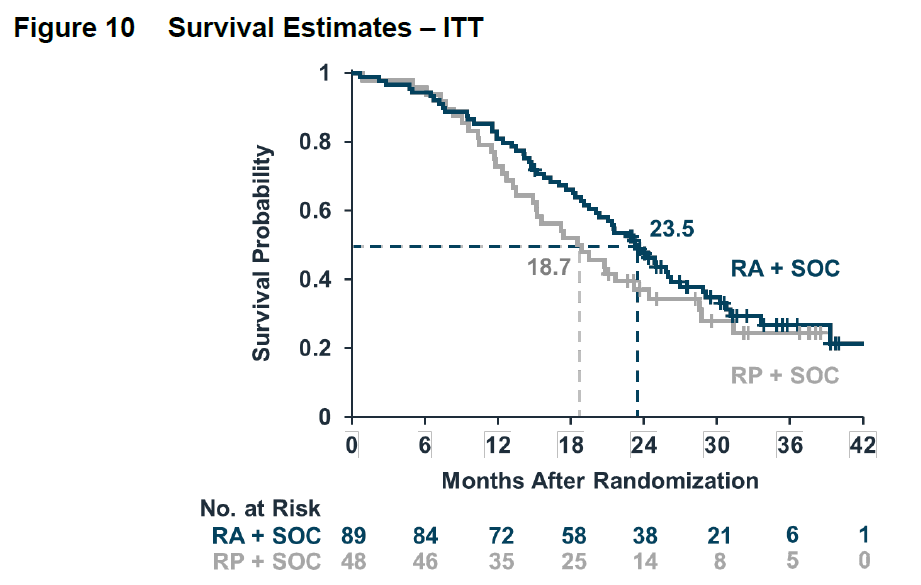

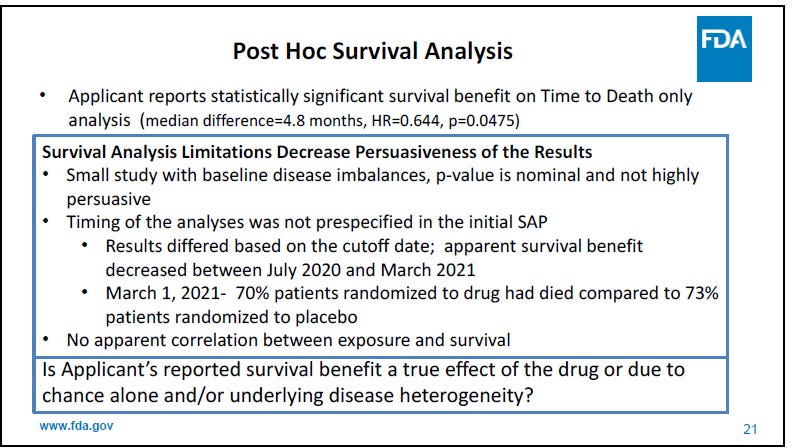

The open-label extension (OLE) survival data however was marginally positive (p=0.0475).

But the FDA wasn’t quite thrilled with that either:

Based on that, the FDA advisory committee voted it down 4-6. But then there was a surprise. After submitting what would generally be considered minor additional data (including a Week 18 responder analysis which was a bit weird considering it was a 24-week trial), the FDA announced a second advisory committee, this time for September. I suspect though that the additional data was just an excuse, the real reason was the outcry from ALS patients:

But after the March meeting, ALS patients and family members took to the internet.

"There were thousands of emails that went to the [FDA] commissioner's office," says Neil Thakur, chief mission officer at the ALS Association, which helped fund the Amylix study. "There were over 1,100 comments that went to the advisory committee themselves, and also there was a sustained effort from ALS clinical scientific leaders."

Besides the second committee meeting, which wouldn’t necessarily turn out any differently from the first, the FDA tipped the scales in the drugs favor in a couple of ways. First, in the September briefing document they added a section “History of regulatory flexibility in ALS” as the other approved treatments didn’t exactly have clean data either. Second, they asked a different question from the March meeting. At that time the question, that was voted down was (emphasis added):

“Do the data from the single randomized, controlled trial and the open-label extension

study establish a conclusion that sodium phenylbutyrate/taurursodiol is effective in the

treatment of patients with amyotrophic lateral sclerosis (ALS)?”

And then in September the question was:

Is the available evidence of effectiveness sufficient to support approval of sodium phenylbutyrate/taurursodiol (AMX0035) for the treatment of patients with ALS? In addition to the prior and new evidence presented, you may take into account in your vote the unmet need in ALS, the status of the ongoing Phase 3 trial, and the seriousness of ALS.

Basically, in March they were asked if the treatment was proven effective and then in September they were asked if it was effective enough for approval, with a specific added consideration of the unmet need. Those are two very different questions and makes it clear that the public (and likely political) pressure on FDA was intense and they wanted this approved, despite the FDA reviewers not being terribly keen on the data. With this change in wording, the panel then voted yes by a vote of 7-2.

So, if the FDA wanted to approve this, why didn’t they just approve it without the additional panel? It’s not like they haven’t gone against a panel before. I think they were looking to cover themselves in case anything went wrong downstream. They had gone against a negative panel when they approved Aduhelm for Alzheimer’s, but that created a bit of a scandal with multiple panel members resigning in protest and the FDA really having nowhere to hide when defending the approval.

That’s the background, what about going forward? There are going to be three key events for the company between now and around April/May. Namely data from a Phase 3 trial of TUDCA run by a EU consortium (TUDCA-ALS), which should be coming any day now (results are actually a bit overdue). Then in March, the company should release earnings results for Q4. Finally, the Phase 3 Phoenix trial results are expected to come out in April/May. I think the first two, and possibly all three events might be negative catalysts for the company (add a potential for a fourth if the Phoenix trial results come out after the Q1 earnings), let me take them one at a time.

First, the TUDCA-ALS study, which is a 337-patient 18-month study. The trial results are likely going to be messy as it’s not being run by a company but by academics. There are going to be a lot more quality control issues with the data than what people are used to. It’s also being run on the cheap as it seems to have just been funded, at least initially, with a €5.6 million grant from the EU. Couple that with the fact that enrollment occurred during COVID and they only followed up with patients every 3 months (which could lead to a lot of missing data as people drop out), chances are high for a lot of devils in the details.

Additionally, the primary endpoint is a responder analysis, with a responder defined as someone with a 20% improvement in ALSFRS. This is an atypical and unvalidated endpoint for ALS The potential exists for a positive primary endpoint and then negative results in ALSFRS itself.

There is a lot of handwringing going on with regards to how different results could impact Amylyx. Seems to me that the generally considered worst case would be either a very negative result (as Phoenix will be questioned) or a very positive result (as people will just start using Amazon TUDCA). The best case for the company is considered to be the scenario where the trial is only a slight failure as it won’t put Phoenix into too much question (as a reminder, Relyvrio is a combination of TUDCA with another drug) and won’t lead to people using Amazon to buy TUDCA. I actually disagree with this, I think any positive result would be good for Amylyx. The biggest issue for them is not the availability of TUDCA online but that people wonder if the drug works at all. Validation, especially external validation, is very important for them to have more normal sales and earnings multiples. But given the trial conduct issues I mentioned above, I doubt it will be positive. It’s hard to get good data in any CNS trial, especially one in ALS, and this one just has too many cards stacked against it.

Next, we have earnings in March. At first glance, the Q3 earnings were quite positive as the company reported $102.7 million in sales for the quarter after just three full quarters of launch. This led to $20.9 million in net income, so really not a bad start. But the stock fell 32% that day because consensus was even higher (which might be the fault of both the company and the analysts) and the discontinuation rate in the US was 40%. And because of that discontinuation rate, the number of net new patients on drug was only 100 during the quarter, down from 800 in the second quarter. The reasons for the discontinuations are likely adverse events as well as the high co-pay of $1000-$2000 per month for many patients. So, we’ll see if the discontinuation rate normalizes, if not they will have to be working very hard just to maintain their current sales level. Clearly this all has created some turmoil internally, with the company announcing on December 7th that their CCO (who spent 10 years at Alexion) is resigning with no replacement named as of yet (which also indicates this wasn’t planned). Given the Co-CEO’s have no commercial experience, this does not bode well for either the Q4 or the Q1 results (likely in May), in my opinion. Q4 was probably already looking challenging when the CCO resigned and then the company has been without one so far in Q1.

Last but certainly not least is the Phoenix trial. This is a 600-patient 12-month trial which is expected to readout in April/May. The arguments that it will work would include that if the effect size from the Centaur trial is replicated here then the results should be highly significant as this has vastly more patients. Additionally as a longer trial, additional separation of the curves might be possible. As a reminder, here are the trendlines from Centaur:

The case for it not to work is simply that, given the borderline significance of Centaur (or non-significance if you go by some of the FDA’s analysis), that result could have been random and this trial will fail. I’m certainly leaning towards this result.

But then what? There has been talk about whether the FDA would pull the drug. I don’t believe that would happen. First, it would likely still create a firestorm from the ALS community, who won’t want a choice taken away from them. Second, after lowering the bar for approval at the second adcomm, will the FDA really want to then reverse itself? It will be easier to just leave it on the market in the spirit of Right to Try. I’m sure though that the product will lose some of the reimbursement. But as long as it is an FDA approved product, I doubt they will lose all reimbursement. Any health plan will likely only have a small number of patients on drug and though the price tag per patient is large, it still won’t move their needle. They are far more concerned with the use of the diabetes/obesity drugs and items of that ilk. Let’s say sales go down by half to $200 million a year and you put a 1x EV/Sales multiple on that (to be on the safe side), add in the cash and you are talking about a $550 million company. As of November 6, 2023, they had 67.5 million shares outstanding. Based on that, a reasonable downside scenario takes you to $8 per share.

But what if the Phoenix trial works? That would improve uptake among physicians and patients and likely also loosen up reimbursement. Additionally, the EU would come into play (so far the CHMP has given negative opinions twice) which could provide another $250 million to the sales line or so. All told, this could be a $1 billion+ product. With some multiple expansion, this could become a $4 billion+ company, which at that valuation would mean a stock at about $60 per share.

With those two scenarios, at the present valuation the market seems to think the downside scenario has about an 85% chance of happening while the upside probability is at 15%. The part of me that is a valuation-oriented contrarian finds this to be an attractive opportunity. But as mentioned, I’m tempered by the fact that we have some negative catalysts coming up that could take the stock down to levels where no success in Phoenix is priced in. At that point, it could be a free call option. And then after the Phoenix data hits, if it’s at least close, I think the apocalyptic scenarios on both reimbursement and FDA withdrawal will be off the table and once again, it would be interesting.

Anyway, thanks for being patient in reading this atypical post of mine, which was really me just putting my thought process about a stock in writing even though I don’t have a firm conclusion yet.

Please like, share and subscribe!

Stocks mentioned:

Do you think a miss on Phoenix could warrant further studies?